It is often said that whatever happens in Vegas, stays in Vegas.

Not this trip! I am too eager to spill the beans of my very own experience in the Neon City.

Despite walking through the Palazzo casino day in, and day out; my trip to Las Vegas was not an adventure for entertainment and gambling, but one of experiential learning, networking, and acquainting myself with the trends and evolutions in the digital payments and fintech space.

Last October, I represented the Interledger Foundation at one of the world’s largest gatherings of the global money ecosystem; MONEY 20/20, the USA edition hosted in Las Vegas.

The Money 2020 Conference (USA)

Money 20/20 is certainly the place where money meets technology. As with the location, the conference was nothing short of world-class. From the giant LED screens, vibrant exhibitions pointed conversations, and insightful presentations to the impressive building architecture and grande conference space at The Venetian, where the 4-day engagement took place.

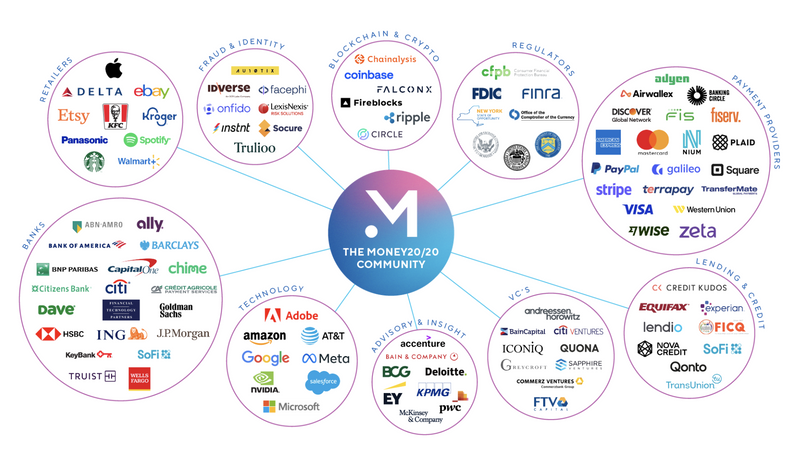

Imagine a space where the entire money community of banks, tech, startups, retail, fintech, financial services, regulators, venture capitalists, and more come together to talk about financial access, inclusion, and innovations. When I say the money and payments ecosystem, I mean representatives from major brands across the globe. Here’s a snapshot of companies in the Money 20/20 community, most of whom were certainly in attendance.

Money 20/20 showcased a vibrant ecosystem of fintech innovations that are reshaping financial services. The 4-day (October 22-25) event featured insightful conversations, diverse discussions, and several 5-minute rants on fintech, real-time payments, the rise of artificial intelligence, the balance between enabling and regulating, consumer protection, and fraud protection. The agenda was divided into learning tracks that aligned with varying themes such as Washington Explained Summit, Age of Fundamentals, Banking Infrastructure Summit, Tech Renaissance, AI Summit, Machine Learning Summit, Trust & Uncertainty, and Fraud Summit.

The Money Hall which opened on day 2 was spectacular; featuring hundreds of companies showcasing their products and services ranging from fraud prevention, payment services, fintech services, and online payment systems. There were also strategically placed, named-appropriate stages where sessions occurred over the last 3 days. Of interest to me where the following:

- The Black Box Stage where pointed conversations about how the Global South is revolutionizing the payments landscape occurred, with a literal black box on the stage.

- The Briefing Room mirrored a press conference set up for announcements and updates on major things happening in the space.

- The Converge Stage, in the center of the hall, where attendees gathered for short but insightful panel discussions and presentations.

- Under the Stars Stage, as the name suggests, had an aesthetic with dimmed lights, and a dark background with stars giving off a mellow, relaxed vibe.

And of course, what's a Conference without fun, exciting social experiences? A whole space was designated as a games arcade (Money Motor Circuit) for unwinding and socializing, there was a business lounge for 1on1 networking and business matchmaking, a MoneyPot podcast booth where people can listen to sessions using headphones, and countless evening socials hosted and presented by various companies.

Sounds like a lot right? Special thanks to our Head of Global Strategy, Ginny Barahona for the pre-trip preparations and guidance on how to make the most of my attendance at this event; and Head of Programs, Chris Lawrence for allowing me to attend the Conference. Before attending the conference, I had the opportunity to preview the agenda and with Ginny’s help built my schedule around the sessions of interest to the Interledger Foundation, and of course, the topics I wanted to learn more about.

I didn’t feel out of place when the event kicked off, as I already knew where I needed to be. Thankfully, the Money2020 app was also a big help with live location mapping which directed me to where I wanted to go. A savor in need for someone like me with a poor sense of direction. I didn’t feel too much like a kid lost in a candy store. :-)

Out with the pleasantries, in with the nuggets.

Technology has the opportunity to expand financial access and inclusion. I’m sure we all can agree with that. However, leveraging technology comes with its potential risks to financial inclusion and stability, consumer protection, and integrity.

The line of conversations and dialogue at Money20/20 focused on those matters. Hop on over to Part 2 (The Thoughts) to read my summary of the main points that resonated with me.

linkedin.com

linkedin.com

Top comments (0)